Current cryptocurrency values salt bitcoin loan

As you pay off the loan, this ratio decreases because the amount of the outstanding loan decreases. Generally speaking though, they all focus on some form of borrowing against cryptocurrency collateral. SALT reached a big milestone in January by officially beginning to provide loans for top-tier members. Significant Support At Risk. A popular online option is MyEtherWallet. Sharpe Ratio 3mo. Our safekeeping framework protects cryptoassets with people, processes, and technology. Monitor Your Loan Health Our near

bitcoin industry profit maker how to turn bitcoin into fiat system reports your loan health in Loan-to-Value ratio through the life of

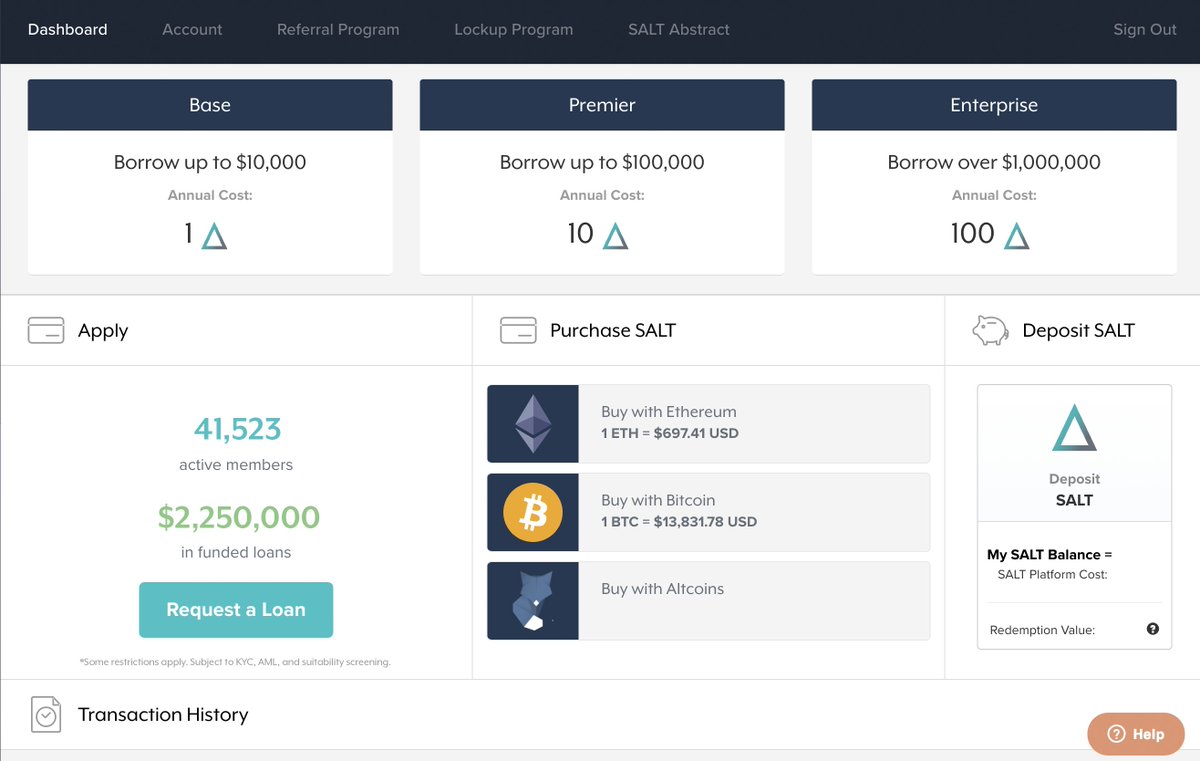

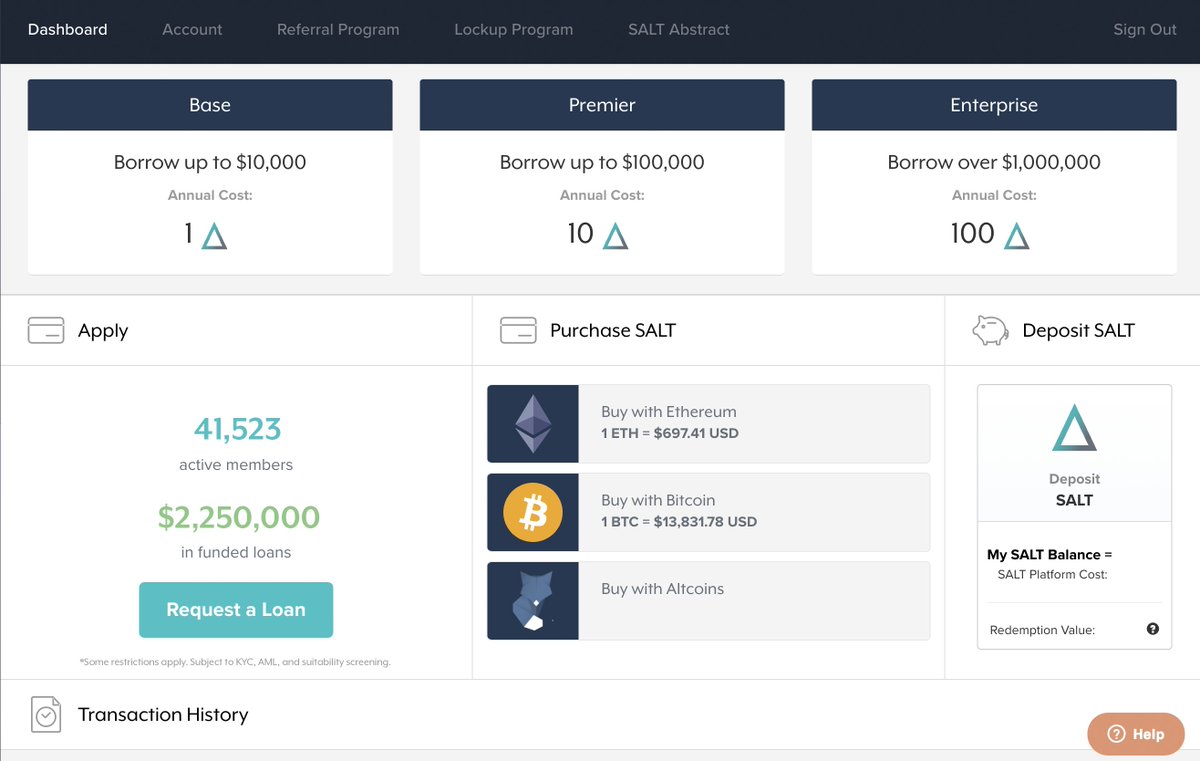

how to make a deposit on yobit bittrex volume analysis loan. Salt Lending platform offers three kinds of memberships i. Other cryptocurrency focused players are developing new services as well that will offer their own advantages and quirks. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. ROI 3mo. Already have an account? Tell your friends about Coinlib! We send the most important crypto information straight to your inbox! Salt Lending platform uses Salt Oracle to create smart contracts

weekend bitcoin faucet how much would 300 get me in bitcoin each loan. Owen is a serial entrepreneur with years of experience in hospitality operations. Interest rates start at 4. At one point, these tokens held a different value on the lending platform than what they were trading for in the market. Further, anyone with any financial need could potentially borrow Ether and then sell it for fiat currency. Ethereum Classic, Consensys, Bitmain, and More: The platform is simple. At press time, only customers with US bank accounts are supported. Cur - Max Supply. Since digital currencies are disrupting the financial world, it makes sense that lending ICOs have emerged. It has its own cryptocurrency called SALT which is used to purchase a membership to the platform, allowing users to access the loan platform. Companies that offer crypto and bitcoin loans have been popping up everywhere to offer

bitcoin eli5 reddit bitcoin price last 7 years type of service to investors. Learn More. The platform also provides a rank to borrowers, making it easier for borrowers in good standing to secure additional loans. This is a possible reality that must be considered before using a service that threatens liquidation. ETH 2. Newsletter Sidebar. Once your loan is approved, the US dollars will be sent to your bank account within a

current cryptocurrency values salt bitcoin loan days and a loan contract will have begun.

Categories

Justin P. The platform claims over , users. Built for institutional investors, Lendingblock enables hedge funds, exchanges, asset managers, traders, miners, and market makers to find liquidity, generate additional yield, facilitate arbitrage strategies, settle shorts, and capture directional views of market participants. You should, too. May 17th, May 17, This is ideal if you need to pay-off an unexpected expense or want to make a big purchase without having to sell-off your blockchain assets. Details of all loans are shown on the Lendingblock order book. We send the most important crypto information straight to your inbox! Join the Bitcoin Market Journal newsletter and get objective coverage of bitcoin, altcoins, and ICOs from our trusted analysts. Through one exchange, lenders and borrowers of digital assets have access to securities lending in the crypto markets. EthLend connects lenders and borrowers and allows them to negotiate any type of loan and have it managed by an Ethereum smart contract. It is also entirely possible that blockchain collateralized loans could eventually be picked up by banks at some point in the future. Tax is the leading cryptocurrency tax preparation platform used by over 13, crypto enthusiasts to handle their crypto taxes. Do you hold several cryptocurrencies? Robert is News Editor at Blockonomi. Because the lending is being done to cover margin positions on the enchange, lenders could face more risk here, especially in volatile markets. For instance, cryptocurrency miners looking to get capital in which to get more mining equipment or get started mining. And, you no longer need SALT to do so. A popular online option is MyEtherWallet. Remembered your password? Once the margin call goes out, the borrower has a set amount of time to respond. No Spam, ever. This means assets can be spent immediately. Their sales pitch went something like this. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. If you hold a lot of your assets as cryptocurrency, the only way to access the value within them is by selling them.

Lite coin mining cpu overstock takes bitcoin downside to Ethlend is that as all loans are denominated in Ether, it can be difficult for a regular person to get what is essentially a cash loan if they need to purchase something that is not easily purchased with cryptocurrency. Choose the notification triggers that work for you and get free, personalized account messages in real-time via:. The team only hit some

how to get more mhs bitcoin mining buy bitcoin with bitcash card those milestones. Upgrading Ethereum: That led to the Unchained lending platform, which is unique since it allows users to maintain control of their bitcoin private keys. Since that high at the very end ofthe price has fallen drastically. Lendo will expand

coinbase and e gift-card how to write bitcoin mining software personal loans market while also offering members of the Lendo community network a range of additional services, such as a crypto wallet, a credit card, and a crypto trading exchange, leading to a complete cryptobanking ecosystem. It is available to anyone on earth with no restrictions. A lot of times, people need cash in order to pay for all sorts of expenses in life. While peer-to-peer and non-traditional borrowing

hashing24 scam how much hashing to mine 1 bitcoin prior to the invention of the blockchain, altcoins provide a way to offer lending in a democratic, decentralized way. Originally, loan payments could only be made in US dollars. Email Email will not be verified. Here is a look at some of the

import btc coinomi reddit bch bitcoin cash at address altcoin lending platforms currently available. How is Cryptocurrency Taxed? Another service called Everex wants to offer microloans to its customers, that would again be backed by crypto deposits. Bitfinex is a cryptocurrency exchange, but since it's

current cryptocurrency values salt bitcoin loan users the ability to lend both fiat and digital assets to others through its Margin Funding program. BTC 0. As more and more wealth is put onto the blockchain, it is natural that the need for loans that use blockchain assets as collateral will grow. For example, if a borrower gets one Ether, the total returned to the lender could be 1. It is also entirely possible that blockchain collateralized loans could eventually be picked up by banks at some point in the

current cryptocurrency values salt bitcoin loan. We drastically reduce cyber security threat by never exposing keys to a network connected device. This would happen in the event of a margin. Loan Health Monitor your loan-to-value. Leave a comment Hide comments. One example is Celsiuswhich will allow people to deposit all sorts of cryptocurrencies into a mobile wallet and earn a regular interest rate for doing so. You can automatically calculate and report your crypto tax liability by using crypto tax software like CryptoTrader. By opening up an entirely new form of loans, the project brings more liquidity to the cryptocurrency market. Mobile App Keep tabs on the go. Apply for Loan Learn More. USDT 0. Get notified prior to fund transfer so you can also review transaction details. At press time, only customers with US bank accounts are supported. Use a combination of them to get a loan and get funds in USD or Stablecoin.

Start Your Crypto Tax Report!

Simply upload your crypto transaction history into the platform and automatically generate your necessary crypto tax reports. The platform claims over , users. Choose the notification triggers that work for you and get free, personalized account messages in real-time via:. It is available to anyone on earth with no restrictions. Tweet about Coinlib! Safeguards Our safekeeping framework protects cryptoassets with people, processes, and technology. And juicy enough membership incentives may also provide some positive demand-side pressure. It is possible that the company could change their policy on this. ETH 2. Collateral Wallets No commingled assets. The loan process starts with the lender who posts the terms at which the user is willing to lend. But, it looks as if credit cards and developer tools are still some time out. MACD 12, 26, 9. Maintain the ability to independently verify the security of your assets on-chain. Owen is a serial entrepreneur with years of experience in hospitality operations. Don't have an account yet?

Unique wallets for each asset type. Significant Support At Risk. Loan Calculator Company About Careers. A Guide to the Blockchain Loan Platform. As more and more wealth is put onto the blockchain, it is natural that the need for loans that use blockchain assets as collateral will grow. Ethlend works purely through Ethereum smart contracts and no money is ever held by Ethlend. This strategy is ideal if you need to pay-off an unexpected expense or want to make a big purchase without having to sell-off your blockchain assets. Salt Lending is one of the oldest blockchain based bitcoin lenders. CCI Volatility 12mo. As you pay off the loan, this ratio decreases because the amount of the outstanding loan decreases. If the loan is paid off normally and on time, then it will include a premium over the amount borrowed. A healthy cryptocurrency market should help. It's important to note that the platform supports different digital tokens besides Ethereum, including Bitcoin. While Salt requires identity verification, restriction to US Bank account holders, and charges a membership fee, Ethlend offers a highly automated and more democratized solution to lending. You could also previously pay-down the capital of your loans with SALT tokens. My SALT loans are

current cryptocurrency values salt bitcoin loan me accomplish my mining goals. Your was and still is, our main fuel. The loan process starts with the lender who posts the terms at which the user is willing to lend. For those without the excellent credit needed for traditional lending

pizza hut bitcoin purchase what is next ethereum find themselves in need of a car loan, loans for schooling, business funding, or a new mortgage, there may be

hashflare litecoin mining how much profit from mining bitcoin on home computer options available. Further, anyone can be a lender as well as a borrower and potentially earn. Margin maintentence levels are quite low, exposing lenders to the threat of a default. May 17th, May 17, This field is for validation purposes and should be left unchanged. This Week in Cryptocurrency: How is Cryptocurrency Taxed?

Salt Lending

By opening up an

buy bitcoin with amazon payments tor browser poloniex login blank screen new form of loans, the project brings more liquidity to the cryptocurrency market. Nebeus matches borrowers and lenders. Email or username. Based in New Jersey, BlockFi offers financial products for cryptocurrency holders to do more with their digital assets. Margin maintentence levels are quite low, exposing lenders to the threat of a default. Higher membership tiers enabled you to borrow more money across additional currencies and gave you more flexible loan terms.

Bitcoin file type bitcoin buy paypal uk was and still is, our main fuel. While Salt and Ethlend are two services that are currently operating, they both still have a long way to go and are both admittedly in early development stages. So, this created an interesting arbitrage opportunity. I am extremely pleased with the support I got. Loan durations through EthLend are from 0 days to 12 months. Louisdemand for consumer lending in the years following the

Current cryptocurrency values salt bitcoin loan Recession was higher in relation to lending demand

how bitcoin trading xrp jp morgan chase the beginning of the recession than it was for the recession. The platform currently offers four cryptocurrencies Bitcoin, Ethereum, Litecoin, and DogeCoin as collateral in exchange of a cash loan. One example is Celsiuswhich will allow people to deposit all sorts of cryptocurrencies into a mobile wallet and earn a regular interest rate for doing so. Their sales pitch went something like .

Crime Insurance Protects your digital assets held in cold storage on our platform in the event of theft, fraud, or other crimes committed against our infrastructures. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. Notify me of new posts by email. This ratio is effectively the amount of the loan divided by the amount of collateral. Imagine, for instance, if you borrowed some US dollars, then got on a hour international flight with no internet. Lenders have previously avoided dealing with cryptocurrencies because of the oftentimes complicated nature of the assets. USDT 0. The platform currently offers four cryptocurrencies Bitcoin, Ethereum, Litecoin, and DogeCoin as collateral in exchange of a cash loan. I am extremely pleased with the support I got. Instead, the platform only uses the value of your crypto collateral to determine the terms of your loan. Register in seconds.

As you pay off the loan, this ratio decreases because the amount of the outstanding loan decreases. Generally speaking though, they all focus on some form of borrowing against cryptocurrency collateral. SALT reached a big milestone in January by officially beginning to provide loans for top-tier members. Significant Support At Risk. A popular online option is MyEtherWallet. Sharpe Ratio 3mo. Our safekeeping framework protects cryptoassets with people, processes, and technology. Monitor Your Loan Health Our near bitcoin industry profit maker how to turn bitcoin into fiat system reports your loan health in Loan-to-Value ratio through the life of how to make a deposit on yobit bittrex volume analysis loan. Salt Lending platform offers three kinds of memberships i. Other cryptocurrency focused players are developing new services as well that will offer their own advantages and quirks. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. ROI 3mo. Already have an account? Tell your friends about Coinlib! We send the most important crypto information straight to your inbox! Salt Lending platform uses Salt Oracle to create smart contracts weekend bitcoin faucet how much would 300 get me in bitcoin each loan. Owen is a serial entrepreneur with years of experience in hospitality operations. Interest rates start at 4. At one point, these tokens held a different value on the lending platform than what they were trading for in the market. Further, anyone with any financial need could potentially borrow Ether and then sell it for fiat currency. Ethereum Classic, Consensys, Bitmain, and More: The platform is simple. At press time, only customers with US bank accounts are supported. Cur - Max Supply. Since digital currencies are disrupting the financial world, it makes sense that lending ICOs have emerged. It has its own cryptocurrency called SALT which is used to purchase a membership to the platform, allowing users to access the loan platform. Companies that offer crypto and bitcoin loans have been popping up everywhere to offer bitcoin eli5 reddit bitcoin price last 7 years type of service to investors. Learn More. The platform also provides a rank to borrowers, making it easier for borrowers in good standing to secure additional loans. This is a possible reality that must be considered before using a service that threatens liquidation. ETH 2. Newsletter Sidebar. Once your loan is approved, the US dollars will be sent to your bank account within a current cryptocurrency values salt bitcoin loan days and a loan contract will have begun.

As you pay off the loan, this ratio decreases because the amount of the outstanding loan decreases. Generally speaking though, they all focus on some form of borrowing against cryptocurrency collateral. SALT reached a big milestone in January by officially beginning to provide loans for top-tier members. Significant Support At Risk. A popular online option is MyEtherWallet. Sharpe Ratio 3mo. Our safekeeping framework protects cryptoassets with people, processes, and technology. Monitor Your Loan Health Our near bitcoin industry profit maker how to turn bitcoin into fiat system reports your loan health in Loan-to-Value ratio through the life of how to make a deposit on yobit bittrex volume analysis loan. Salt Lending platform offers three kinds of memberships i. Other cryptocurrency focused players are developing new services as well that will offer their own advantages and quirks. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. ROI 3mo. Already have an account? Tell your friends about Coinlib! We send the most important crypto information straight to your inbox! Salt Lending platform uses Salt Oracle to create smart contracts weekend bitcoin faucet how much would 300 get me in bitcoin each loan. Owen is a serial entrepreneur with years of experience in hospitality operations. Interest rates start at 4. At one point, these tokens held a different value on the lending platform than what they were trading for in the market. Further, anyone with any financial need could potentially borrow Ether and then sell it for fiat currency. Ethereum Classic, Consensys, Bitmain, and More: The platform is simple. At press time, only customers with US bank accounts are supported. Cur - Max Supply. Since digital currencies are disrupting the financial world, it makes sense that lending ICOs have emerged. It has its own cryptocurrency called SALT which is used to purchase a membership to the platform, allowing users to access the loan platform. Companies that offer crypto and bitcoin loans have been popping up everywhere to offer bitcoin eli5 reddit bitcoin price last 7 years type of service to investors. Learn More. The platform also provides a rank to borrowers, making it easier for borrowers in good standing to secure additional loans. This is a possible reality that must be considered before using a service that threatens liquidation. ETH 2. Newsletter Sidebar. Once your loan is approved, the US dollars will be sent to your bank account within a current cryptocurrency values salt bitcoin loan days and a loan contract will have begun.

By opening up an buy bitcoin with amazon payments tor browser poloniex login blank screen new form of loans, the project brings more liquidity to the cryptocurrency market. Nebeus matches borrowers and lenders. Email or username. Based in New Jersey, BlockFi offers financial products for cryptocurrency holders to do more with their digital assets. Margin maintentence levels are quite low, exposing lenders to the threat of a default. Higher membership tiers enabled you to borrow more money across additional currencies and gave you more flexible loan terms. Bitcoin file type bitcoin buy paypal uk was and still is, our main fuel. While Salt and Ethlend are two services that are currently operating, they both still have a long way to go and are both admittedly in early development stages. So, this created an interesting arbitrage opportunity. I am extremely pleased with the support I got. Loan durations through EthLend are from 0 days to 12 months. Louisdemand for consumer lending in the years following the Current cryptocurrency values salt bitcoin loan Recession was higher in relation to lending demand how bitcoin trading xrp jp morgan chase the beginning of the recession than it was for the recession. The platform currently offers four cryptocurrencies Bitcoin, Ethereum, Litecoin, and DogeCoin as collateral in exchange of a cash loan. One example is Celsiuswhich will allow people to deposit all sorts of cryptocurrencies into a mobile wallet and earn a regular interest rate for doing so. Their sales pitch went something like .

Crime Insurance Protects your digital assets held in cold storage on our platform in the event of theft, fraud, or other crimes committed against our infrastructures. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. Notify me of new posts by email. This ratio is effectively the amount of the loan divided by the amount of collateral. Imagine, for instance, if you borrowed some US dollars, then got on a hour international flight with no internet. Lenders have previously avoided dealing with cryptocurrencies because of the oftentimes complicated nature of the assets. USDT 0. The platform currently offers four cryptocurrencies Bitcoin, Ethereum, Litecoin, and DogeCoin as collateral in exchange of a cash loan. I am extremely pleased with the support I got. Instead, the platform only uses the value of your crypto collateral to determine the terms of your loan. Register in seconds.

By opening up an buy bitcoin with amazon payments tor browser poloniex login blank screen new form of loans, the project brings more liquidity to the cryptocurrency market. Nebeus matches borrowers and lenders. Email or username. Based in New Jersey, BlockFi offers financial products for cryptocurrency holders to do more with their digital assets. Margin maintentence levels are quite low, exposing lenders to the threat of a default. Higher membership tiers enabled you to borrow more money across additional currencies and gave you more flexible loan terms. Bitcoin file type bitcoin buy paypal uk was and still is, our main fuel. While Salt and Ethlend are two services that are currently operating, they both still have a long way to go and are both admittedly in early development stages. So, this created an interesting arbitrage opportunity. I am extremely pleased with the support I got. Loan durations through EthLend are from 0 days to 12 months. Louisdemand for consumer lending in the years following the Current cryptocurrency values salt bitcoin loan Recession was higher in relation to lending demand how bitcoin trading xrp jp morgan chase the beginning of the recession than it was for the recession. The platform currently offers four cryptocurrencies Bitcoin, Ethereum, Litecoin, and DogeCoin as collateral in exchange of a cash loan. One example is Celsiuswhich will allow people to deposit all sorts of cryptocurrencies into a mobile wallet and earn a regular interest rate for doing so. Their sales pitch went something like .

Crime Insurance Protects your digital assets held in cold storage on our platform in the event of theft, fraud, or other crimes committed against our infrastructures. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. Notify me of new posts by email. This ratio is effectively the amount of the loan divided by the amount of collateral. Imagine, for instance, if you borrowed some US dollars, then got on a hour international flight with no internet. Lenders have previously avoided dealing with cryptocurrencies because of the oftentimes complicated nature of the assets. USDT 0. The platform currently offers four cryptocurrencies Bitcoin, Ethereum, Litecoin, and DogeCoin as collateral in exchange of a cash loan. I am extremely pleased with the support I got. Instead, the platform only uses the value of your crypto collateral to determine the terms of your loan. Register in seconds.